GGII data shows that since China became the world's largest industrial robot market in 2013, it has maintained an average annual growth rate of more than 30%. Especially in 2017, China's industrial robots ushered in an 'explosion'. In 2018, most robot manufacturers Set off 'expansion tide'.

However, this year, my country's economy has faced many challenges, such as the Sino-US trade war, the transformation and upgrading of China's overall economy, from consumption upgrade to consumption downgrade, the change from 'demographic dividend' to 'talent dividend', and the adjustment of social security tax collection... Last year was full of expectations. It doesn't seem to be doing well this year.

According to the latest data from the Bureau of Statistics, China produced 11,448 industrial robots in September, down 16.4% year-on-year. From high growth to slower growth to negative growth, uncertainty is growing.

Many companies in the robot industry chain are trying to return to the origin, identify opportunities, build their own capabilities, rethink the way out for companies, and reposition the development of the robot industry. 'Flexible manufacturing' has become a breakthrough. The application of robots in the automotive and 3C electronics manufacturing industries accounts for more than 65%. In the opinion of Zhang Wei, general manager of the Robotics Division of Eft, these two industries have a high degree of standardization and belong to the single-piece large-scale industry. Manufactured in batches and exist in large manufacturing enterprises.

He believes: 'Foreign robots account for a relatively high proportion in the automotive industry and have obvious advantages. They have different application advantages in general industry. This is an opportunity area for domestic independent brand robots to compete.'

'China's large-scale production accounts for no more than 20% of the number of Chinese manufacturing enterprises, and the rest is more inclined to flexible manufacturing.' Wang Jiapeng, co-founder of Jieka Robot, pointed out that the future market of robot applications is not only in the large-scale manufacturing of industry leaders The scenario is more a flexible manufacturing scenario with a large volume and a wide range of small and medium-sized enterprises under the 'sea level'. There are many blank points and many points that have not been solved by automation.

In fact, flexible manufacturing means 'remaining unchanged', efficient organizational structure, flexible planning of production cells, process switching through software configuration or parameter adjustment, modular mechanical and electrical components, and automation software solutions, etc. The 'unchanged' core elements respond to the 'changing' market demand, production line status, etc., so that small batch and mass customization production can achieve the cost advantage of mass production.

Suo Liyang, deputy general manager of Peitian Robotics, also pointed out that the requirements of flexible manufacturing involve seven aspects, including machine flexibility, process flexibility, product flexibility, maintenance flexibility, production capacity flexibility, expansion flexibility, and operation flexibility.

In the face of 'uncertainty', more and more robotics companies have begun to focus on flexible manufacturing scenarios, and regard it as an opportunity in the 'Winter Tibet Plan', and use this to realize the 'spring birth' in the coming year.

Therefore, the question of 'how to effectively support the entire industrial chain of robots to help flexible production' is particularly important. Industrial robot bodies, system integrators, and intelligent components constitute a 'trilogy' of flexible manufacturing counterattacks. How can the requirements of flexible manufacturing for industrial robots allow robots to provide stronger support for flexible manufacturing? Soliyang believes that the first is to improve the quality of industrial robots, including performance, life, reliability, safety, economy, appearance, maintainability, service, etc.

'Performance' includes accuracy, speed, acceleration, jerk, rigidity, etc.; 'Life' includes the trend of accuracy degradation, wear trend, temperature, and lubrication; 'Reliability' generally refers to the mean time between failures; 'Safety' includes Anti-misoperation, anti-collision, soft and hard limit, safety tips; 'Economy' includes purchase cost, maintenance cost, service cost and the cost of secondary development required to cooperate with industrial robots and other equipment.

'Appearance', including industrial design, ease of use, human-computer interaction, painted appearance, etc., is particularly important for products that are going to enter the international market; 'Maintainability' includes quick maintenance, self-diagnostic analysis, installation and Replacement method; 'service' mainly refers to quick response, which is the advantage of domestic robot manufacturers and a point that customers care about very much.

Finally, in special application environments, such as moisture, corrosion, flammable and explosive, etc., the robot is required to be waterproof, dustproof, explosion-proof, and corrosion-resistant.

In the category of industrial robots, collaborative robots have high flexibility. The relevant person in charge of Universal Robots introduced that the working platform using the collaborative robot can become a flexible workstation in the factory; the customer can easily move the robot workstation to the designated position according to the production arrangement, and by calling the pre-set program, after a simple debugging You can start working directly.

In addition, from the raw material warehouse to the production line, and then to the material transportation in the finished product warehouse, AGV plays a great role in highly flexible handling, that is, it realizes rapid deployment without changing the original production line, and integrates vision and positioning. Navigation, motion control, cluster scheduling and other technologies are integrated in the AGV to form a flexible production line.

It can be seen that the robot body manufacturers in the three links of research and development, production and service have perfect cooperation with core component suppliers, smart component providers, top-level designers of smart factories, and industry solution integrators. Only then can it be called high integration. In this way, the quality of the robot is reflected, and the role of the robot in flexible manufacturing can be better played. System integration actively expands to the short life cycle market At present, system integrators are mainly faced with two choices: to be a leading enterprise or a small and medium-sized enterprise.

There is a lot of opportunity for leading customers, which can become the main profit point of integrators. At the same time, there are also great risks. One prosper and one loses. The future strategy of small and medium-sized enterprises is flexible manufacturing. The large-scale production needs of customers are quite different.

Facing flexible manufacturing, manufacturers with rich industry application experience and precision product R&D technology have natural advantages. They have begun to actively explore flexible manufacturing scenarios and implement projects, and work with partners to jointly develop the blue ocean of flexible manufacturing.

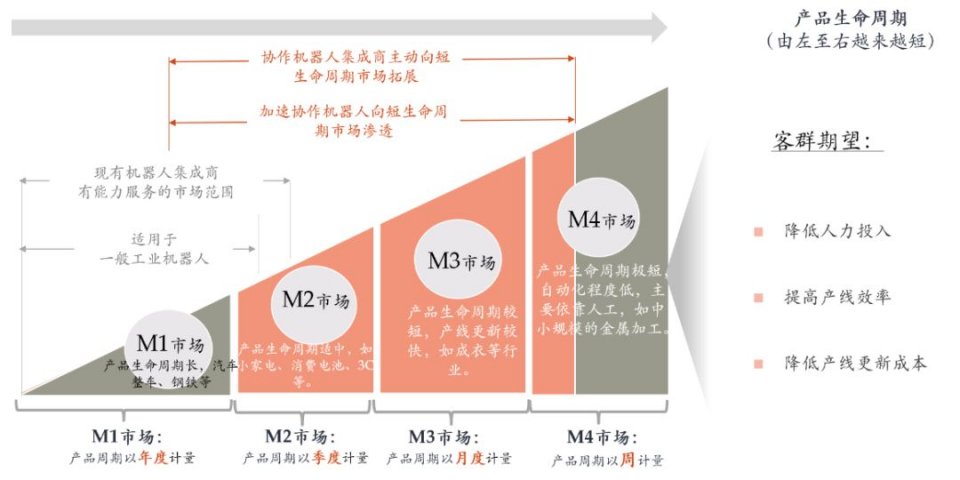

The flexible manufacturing business model diagram created by Jieka has certain reference significance. According to the expectations of customer groups on 'reducing human input, improving production line efficiency, and reducing production line renewal costs', China's manufacturing industry is divided into product life cycles. Four major manufacturing markets:

Products in the M1 market have a long life cycle, measured in 'annual', such as complete vehicles, steel, etc.;

The product life cycle of the M2 market is moderate, measured in 'quarters', such as small appliances, consumer batteries, 3C, etc.;

The M3 market has a short life cycle, and the production line is updated quickly, which is measured by 'monthly', such as clothing and other industries;

The life cycle of the M4 market is extremely short, measured in 'weeks', with a low degree of automation, mainly relying on labor, such as small and medium-scale metal processing.

Among them, a small part of the market of M1 and M2 is suitable for general industrial robots, and is the market scope that existing robot integrators are capable of serving. With the continuous increase of automation penetration, the M1 market has reached a high automation rate, and the space for automation transformation has narrowed. As a result, the industry began to pay attention to the M2 market represented by the 3C industry.

The competition in the 3C industry has become more intense, and integrators have begun to actively expand into the market with shorter life cycles. The cost structure of this type of market mainly includes the cost of the robot body and the original sensor, as well as the deployment cost including installation and commissioning, manpower, and the meager profit, which has largely determined the marginal cost of the integrator.